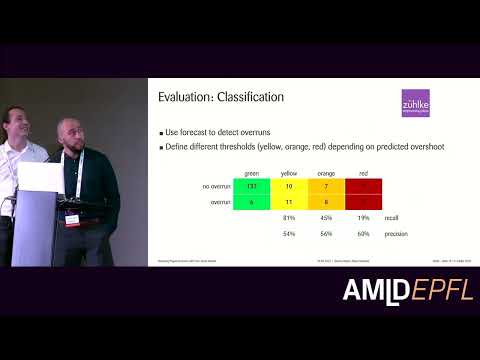

Financial project overruns occur in nearly all contexts. Whereas their causes can be manifold and sometimes hard to influence, an early detection of such overruns increases the chance of taking counteracting measures and might even prevent the accident at all. This requires a careful monitoring of a project’s finances. However, especially in a context with many simultaneously running projects, for example in a service providing company, this can be a challenge and often a dedicated team is set up for this task. In such companies, there is a high demand for automation to further scale this process. However, rule-based monitoring approaches quickly reach their limits, as a project’s spendings can become very complex. Time series models have the potential to further support hereby learning from the project history to forecast future costs. We developed a time series model on hundreds of previous projects. The model showed great potential not only in detecting future overruns but also in providing generally helpful forecasts about the project’s finances. In this talk, we present the project context and how we modeled the problem. We then show different approaches we have chosen and evaluate the corresponding models. We furthermore talk about how we embed the resulting forecast model in our company and our learnings.

Download the slides for this talk.Download ( PDF, 1055.33 MB)