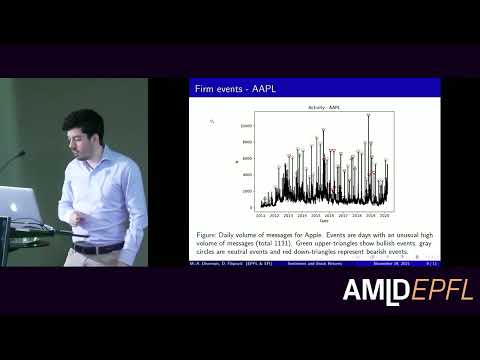

90 million messages are scraped from StockTwits over 10 years and classified into bullish, bearish or neutral classes to create firm-individual sentiment polarity time-series. Polarity is positively associated with contemporaneous stock returns. On average, polarity is not able to predict next-day stock returns but when we focus on specific events (defined as sudden peak of message volume), polarity has predictive power on abnormal returns.

Download the slides for this talk.Download ( PDF, 382.61 MB)